President Eisenhower, as quoted in the 1956 Republican Party Platform, gives a rousing call for shared prosperity, cooperation, and balancing logic with empathy:

"The individual is of supreme importance.

The spirit of our people is the strength of our nation.

America does not prosper unless all Americans prosper.

Government must have a heart as well as a head.

Courage in principle, cooperation in practice make freedom positive.

To stay free, we must stay strong."1

Here was a Republican who expanded Social Security, accelerated desegregation of the armed forces, proposed and ultimately signed important civil rights legislation, and derided those like today's Republican leadership who would threaten the social safety net. It's well known that he wrote,

"Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H. L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid."2

However, while it's rarely mentioned alongside this popular quote, President Eisenhower was writing in response to his brother Edgar, who had accused him of pursuing the same policies in foreign relations and many domestic policies as the previous administration, that of Democrat Harry Truman. In context, it would appear that President Eisenhower's reasons for defending the pursuit of those programs had little or in some cases perhaps even nothing whatsoever to do with whether or not he believed in their being wholly good programs. Rather, as he wrote in that same letter, "the Federal government cannot avoid or escape responsibilities

which the mass of the people firmly believe should be undertaken by it"

2. The point was that the people believe those programs to be the proper business of the government and so it would be folly for him to end the programs demanded by the people. It was not necessarily that he personally agreed with all of the programs, it was that he was a representative of a people whom he knew to have given him no mandate to end any of those safety net programs.

It is clear that President Eisenhower supported some (if not all) safety net programs. For instance, in his 1953 State of the Union address to Congress, he included a recognition of the need for at least certain social services and safeguards.

"This administration is profoundly aware of two great needs born of our living in a complex industrial economy. First, the individual citizen must have safeguards against personal disaster inflicted by forces beyond his control; second, the welfare of the people demands effective and economical performance by the Government of certain indispensable social services."3

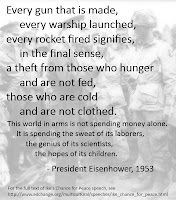

It's also clear that his budgets put federal money where his mouth was in that regard, as the frequent cuts through his first term mainly hit the defense sections while social security steadily grew. Those reductions in defense spending bring to mind another of his famous quotes from the Chance for Peace speech,

"Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone.

It is spending the sweat of its laborers, the genius of its scientists, the hopes of its children."4

Even through his second term, while defense spending returned to rising, by the time of his final budget defense spending still had not returned to the level of his first budget. This lowered spending suggests that he really meant it and worked to avoid spending more than he felt was necessary ... so as to avoid committing even more "theft from those who hunger and are not fed". However, like so many quotes from times past, one could easily read too much into President Eisenhower's lamenting of the resources spent on the military. Remember, this was a retired general speaking. He wasn't about to unilaterally disarm while others didn't. Nor would he likely have accepted such a massive reduction in forces that our ability to respond to unanticipated threats would be crippled. Instead, he only hoped to reach agreement with opposing powers that would reduce the scale of military spending with potential aspects such as, "limitation, by absolute numbers or by an agreed international ratio, of the sizes of the military and security forces of all nations."

4 One can not properly read an opposition to all military spending into this retired general's statement. On the contrary, he later wrote in a letter,

"My great difficulty is in realizing that anyone in this country, even for partisan reasons, would entertain for a moment the thought that I would let our defense structure be undermined to a danger point. What I am trying to do is to keep a clearly adequate security and our economy sound, preserving the integrity of our dollar both at home and abroad. At the same time we must not drain off from our economy so much money in taxes that we diminish too markedly the private funds needed for expansion."5

Clearly he was not universally opposed to military spending but rather concerned with prudent allocation, i.e. with not allowing unconstrained military spending to swallow up too large a portion of our resources.

"Our problem is to achieve adequate military strength within the limits of endurable strain upon our economy. To amass military power without regard to our economic capacity would be to defend ourselves against one kind of disaster by inviting another."3

It was not a

cut at all costs imperative, as he acknowledged the value of some military and social spending, "balancing the budget is not so important as the performance of those governmental functions that are designed to sustain our security and promote economic development."

6 But like today's laissez-faire proponents, he believed that money spent by the government would drain off our economy and diminish the private sector. And like today's inflation hawks, he believed that "a rash of spending ... would encourage inflation".

7 And conversely he believed that restraining spending would "do much to sustain the integrity and purchasing power of our dollar".

8 He considered deficits "one of the inciting causes" of inflation.

8 Reading Eisenhower's various comments on balancing the budget, one is struck by how similar his reasoning is to conservatives of later years except that he stressed the importance of reducing spending

before reducing taxes,

9 whereas current Republicans are willing to reverse that order.

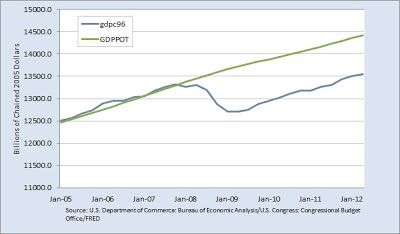

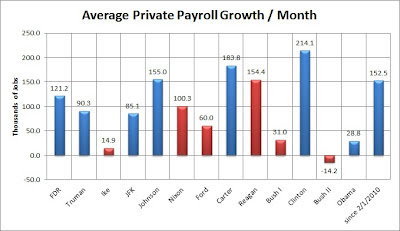

Unfortunately for President Eisenhower's economic legacy, his budget cuts were not without costs of their own. Inflation-adjusted median income grew by just 1.83% from 1953 to 1960 as opposed to the 9.17% from 1947 (start of available data) to 1952 under Truman or the 20.08% from 1961 to 1968 under Kennedy/Johnson.

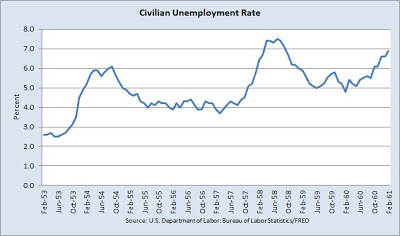

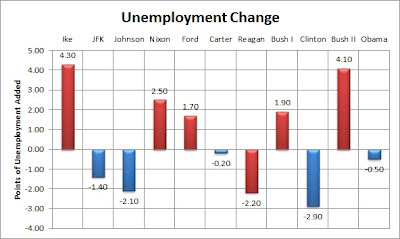

10 And unemployment under his watch

rose from 2.6% to 6.9%. While he did manage multiple balanced budgets with his fiscal restraint, he did so to the detriment of the economy that he sought to improve.

Sources:

- 1956 Republican Party Platform

- http://www.eisenhowermemorial.org/presidential-papers/first-term/documents/1147.cfm

- 1953 State of the Union address to Congress

- Chance for Peace

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1107.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/497.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1114.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1042.cfm

- http://www.eisenhowermemorial.org/presidential-papers/first-term/documents/279.cfm

- https://www.census.gov/hhes/www/income/data/historical/people/2011/P04_2011.xls