We're in a depression. To many, that's stating the obvious. But it seems not quite everyone realizes just yet.

|

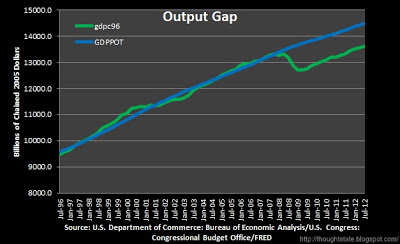

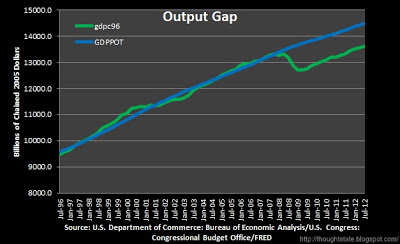

| GDP depressed below normal levels from 2008 through this writing |

Our commerce has been significantly below capacity for several years. By the end of 2008 the quarterly output gap exceeded even the previous record (from 1982) for output gaps since 1949. We've seen the main characteristic factors of depression beyond just the raw output gap: increased unemployment, tight credit for consumers and small business, and bank failures (though many of the potential failures were averted). And as anyone familiar with Irving Fisher's work should know, we'd surely have had significant

deflation from the paying down of private debts were it not for a series of Fed actions to mitigate deflationary forces.

Deficit hawks ignore the reasons for our deficits in recent years. Depressions increase short-term costs. People out of work utilize the safety net when they wouldn't otherwise. We have a severe short-term increase in costs. At the same time, depressions also reduce revenue. We bring in less tax money because fewer people are getting paid, and often smaller real wages.

There's one clear answer to get rid of deficits: get people back to work. Rev up the economy back to potential. Close the output gap. Until we do that, we'll continue to have increased costs and reduced revenues.

In our attempts to close that output gap, today's fiscal conservatives hamstring us with massive state budget cuts to avoid the temporary tax increases and/or bond issuance needed for dealing with the downturn. Their unwillingness to raise revenue means lots of layoffs, slowing down our economy while hurting the quality of services that we the people want. Many of us would willingly pay more in taxes to keep quality of service through an economic downturn. Many of us would be more than willing to pay more in taxes to keep investing in the sort of growth-spurring government measures that can get us back to expansion. But fiscal conservatives will brook no such sensibility. So instead we get slower growth and less prosperity. Like our slow recovery? Thank a fiscal conservative. Like our rising tuition costs for students? Thank a fiscal conservative. Like our broken roads increasing business costs? Thank a fiscal conservative. Like fewer research patents being licensed to domestic businesses than we'd otherwise have over the coming years? Thank a conservative.

This impact is nothing new. We had deficit hawks and credit growth hawks to thank for the recession of 1937-38 when attempts to balance the budget and tighten monetary policy put a crimp in recovery from the Great Depression. We had sharp cuts in the name of balanced budget zeal to thank for the recessions and increased unemployment under Eisenhower. Time and again, we keep having to re-learn the lesson that sharp cuts hurt even when they're earnestly meant to help.

We're long overdue to stop letting fiscal conservatives shape the narrative. We need to stop worrying about balancing the budget when we're in the midst of a downturn. When the economy's roaring at full steam, then we can afford to mess about with budget balancing. Until then, we can't afford their cuts.

One needs to already be in good shape to recover from a deep, large, sharp cut. Until we've eliminated the output gap, we need more recovery efforts ... not more cuts.