Here be dragons of economics, politics, and news ... traditionally non-partisan, but we've got to admit that we find one of the parties makes that rather hard to maintain in the present day

Saturday, December 22, 2012

The Difference Between Assault Weapons and Cold Medicine

Quick, Ethel, call the cops; he could be dangerous. Oh, never mind ... it was just an assault rifle ... not something suspicious like, oh, cold medicine.

Labels:

assault weapons,

gun control

Minsky on Recovery

"Pundits, politicians, and officials have proclaimed that the economy escaped the near crisis of 1974-75 as a result of the normal functioning of market processes. In truth, the braking of the downswing and the subsequent recovery were largely the result of strong fiscal measures and prompt lender-of-last-resort interventions. The fiscal measures were partly automatic because of massive entitlement (transfer payment) programs and a tax system in which receipts fell sharply when employment fell and were partly discretionary in the form of tax rebates, tax reductions, and extensions of unemployment insurance."

-- Hyman P. Minsky, from "Stabilizing an Unstable Economy"

-- Hyman P. Minsky, from "Stabilizing an Unstable Economy"

Saturday, December 15, 2012

Politics, It Shouldn't Be A Pejorative

Politics is good. I don't mean entertaining. It's outright good.

It gets a bad name. We too often say, "Oh, they're just doing that for political reasons." As if that were a obviously a bad thing. As if that meant it was just cynical, fake, pointless, and probably not earnest.

But think about it: why do many people avoid talking politics or religion with close friends and family?

The reason: because these are things about which people care deeply and passionately. These are things about which people can get into bitter arguments over what are technically small differences. People worry about losing friends and family to political arguments because political matters typically REALLY DO MATTER. We care deeply about the implications of those little differences.

To say that something is political is often to say that it is an issue about which people would care enough to fight, to take action. To do something for political reasons means nothing other than that you recognize society is complex and that for reasons of practicality you often need to work out a nuanced compromise in order to promote that about which you really care.

It gets a bad name. We too often say, "Oh, they're just doing that for political reasons." As if that were a obviously a bad thing. As if that meant it was just cynical, fake, pointless, and probably not earnest.

But think about it: why do many people avoid talking politics or religion with close friends and family?

The reason: because these are things about which people care deeply and passionately. These are things about which people can get into bitter arguments over what are technically small differences. People worry about losing friends and family to political arguments because political matters typically REALLY DO MATTER. We care deeply about the implications of those little differences.

To say that something is political is often to say that it is an issue about which people would care enough to fight, to take action. To do something for political reasons means nothing other than that you recognize society is complex and that for reasons of practicality you often need to work out a nuanced compromise in order to promote that about which you really care.

Friday, December 14, 2012

Emperor, Please Put On Some Clothes

The emperor is most certainly stark naked before the public he's called together to see his "new clothes".

Who is this emperor? Today's emperor is more of a committee. The power players on the committee are the current office holders from the Republican party. Who sold them the clothes and are also the committee's most trusted advisers? That would be the "Chicago" school of dubious economists and similar Very Serious People who've claimed that we should fear nothing from cutting government spending because -- with the wonderful magic loom of "not crowding out" -- every item we remove from government spending will be replaced by an equal item of resurging private spending. For example, as recorded by Menzie Chinn, there's the claim from Mr. Brian Riedl of the Heritage Foundation that,

"Every dollar Congress injects into the economy must first be taxed or borrowed out of the economy. No new spending power is created. It is merely redistributed from one group of people to another."That there's some invisible clothing, that is. See, if you're a Very Serious Person, you'll see the magic clothing because only those silly, unworthy folks can't see the special invisible clothing that comes from reducing crowding out. Really. You believe us, right? Because if you don't, you must be one of those silly, unworthy folks.

Enter the child in the crowd, in this case played by various credible economists with good track records for accuracy: e.g., Paul Krugman and others who read our situation right and generally accurately predicted how things would play out from each move that's been taken. These folks -- like the child in the classic story -- have been unconcerned that pointing out the emperor's factual nudity might cause them to be seen as silly, unworthy folks by the powers that be. They see that the emperor is stark naked ... and, well, he's wrinkly and it's unappealing ... they're seeing sights that they'll never be able to un-see no matter how hard they try ... so they're going to darn well point it out in the hopes that he'll cover himself up with something real instead of these fake, imaginary garments from the Very Serious People.

I'm sorry, but Ricardian Equivalence is no substitute for honest clothing. Crowding out isn't going to be a significant factor in a demand-depressed economy such as the one in which we currently live. We can not expect that private spending will step up to fill the void if we cut government spending at this point. We can only expect that to leave us naked.

I'm sorry, but Ricardian Equivalence is no substitute for honest clothing. Crowding out isn't going to be a significant factor in a demand-depressed economy such as the one in which we currently live. We can not expect that private spending will step up to fill the void if we cut government spending at this point. We can only expect that to leave us naked.

Thursday, December 13, 2012

Why Johnny Can't Cut Spending

Well, said, Jonathan Chait. Well said, indeed!

(The Johnny in the title "Why Johnny Can't Cut Spending" refers to Speaker Beohner, not Mr. Chait.)

From "Why Republicans Can’t Propose Spending Cuts",

(The Johnny in the title "Why Johnny Can't Cut Spending" refers to Speaker Beohner, not Mr. Chait.)

From "Why Republicans Can’t Propose Spending Cuts",

"Reporters are presenting this as a kind of negotiating problem, based on each side’s desire for the other to stick its neck out first. But it actually reflects a much more fundamental problem than that. Republicans think government spending is huge, but they can’t really identify ways they want to solve that problem, because government spending is not really huge. That is to say, on top of an ideological gulf between the two parties, we have an epistemological gulf. The Republican understanding of government spending is based on hazy, abstract notions that don’t match reality and can’t be translated into a workable program."This is exactly the problem! We have one major party that has some idea -- if an imperfect grasp -- of what's going on struggling to reach agreement with the other major party ... the one that not only has no idea what's going on but fundamentally opposes the whole idea of what's really going on at an ideological level. We're dealing with a faith-based community of Republicans who insist that we really need to cut spending. But it's just because they believe in cutting spending for its own sake. There is no logical grounds for dramatically cutting spending supported by cold, hard fact. There is only a doctrine claiming that cutting spending is always the right thing in all circumstances. That's incorrect. And it's a harmful error ... a potentially disastrous error.

Tuesday, December 11, 2012

Even Those Facing The "Cliff" Not Necessarily Facing Its Meaning

Krugman on what the "fiscal cliff" means to the Very Serious People in "Heritage, Chicago, and the Fiscal Cliff":

"So if you think the fiscal cliff matters, you also, whether you know it or not, believe that a whole school of macroeconomics responded to the greatest economic crisis since the Great Depression with ludicrous conceptual errors, of a kind nobody has had a right to make since 1936 at the latest."What's the nature of the problem in the "fiscal cliff"? Spending cuts while the economy is weak hurt the economy. One would think that a hard reality to swallow for the folks buying the Chicago notion that public spending cuts will somehow mystically always be replaced by an equal amount of increased private investment no matter what the state of the economy.

Friday, December 7, 2012

The Austerity Crusade Fails Again; If Only They'd Listen To Keynes

It shouldn't have needed yet another proof, but here it is: as John Cassidy puts it, "an official confirmation from the United Kingdom that austerity policies don’t work."

Anybody who works from a knowledge of economic history already knew that. But the high priests of Supply-side were sure. All they needed to do was to be sufficiently faithful to their doctrine. It didn't work. And nobody who even came close to understanding Keynes was surprised by anything other than the deficit-hawks continued belief that balancing the budget will somehow cure all the ails us. Cure it because ... um ... underpants? Surely that's it. The balancing of the budget would cause the confidence fairy's underpants to fit better and she would come dancing along to rain blessings upon us for so dutifully cutting to balance our budgets.

After all, it surely all comes back to underpants, at least when we're dealing with the faith-based economics of Supply-siders (the Trickle-down-istas). For anyone who's seen South Park's "underpants gnomes" and their business plan:

- Collect underpants

- ?

- Profit!

It's the very same with deficit-hawks:

- Balance the budget

- ?

- Profit!

It really does require a pure leap of faith to jump off that cliff. Sadly, there are sharp, pointy rocks below and there really is no confidence fairy waiting around to boost folks back onto solid ground after they slash budgets during a downturn. So march off to the austerity crusade boys. And don't forget to inflict lots of suffering on your economy because that's the only way to scare the evil spirits out of it. Right? We just have to believe hard enough and the confidence fairy will appear. Never mind those rocks. We're not plummeting towards them, they're just growing bigger. That's all.

But no, that's not all. Austerity fails. At least from where we are. Austerity will be harmful so long as we're demand-constrained rather than supply-constrained. And we're clearly demand-constrained rather than supply-constrained. So anyone who was paying attention should have known not to cut spending. But the Supply-side faithful would have nothing of it. Listen? Pay attention to history? Heck no!

Can we please stop with the misguided, ill-timed budget-cutting when our economy isn't roaring along? Pretty please? Austerity fails. Supply-side fails. Trickle-down doesn't trickle down. We can only safely cut when we're already doing well ... preferably when we're overheated. We're not suffering from overabundance. If we bleed our economy of government spending, all that'll do is make the patient more sick. Enough with the "harsh medicine" already. It'll only hurt.

Labels:

austerity,

budget,

confidence fairy,

deficit,

Keynes,

Supply-side,

trickle-down,

underpants,

United Kingdom

Thursday, December 6, 2012

Obstructionism and Topping a Pile with a Ribbon

Krugman on the GOP plans to stand in the way of what needs to be done with every ounce of their misguided capacity:

"And one thing to think about: if the next two years are, as they seem likely to be, one long Republican tantrum, the 2014 election is not going to be a normal midterm. It will instead be a referendum on GOP obstructionism, which may attract a lot more attention — and much higher turnout — than normal."He may be right. And if so, let's hope the electorate sees through the cheap tricks the Republicans will surely continue to apply, just as they have in recent years. It may be too early to be particularly confident that GOP dirty tricks won't pull them through the next election.

Tuesday, November 20, 2012

Robert Reich, The Budget Deficit, and Government Spending

From Robert Reich's, "Why We Should Stop Obsessing About The Federal Budget Deficit",

"Public investments that spur future job-growth and productivity shouldn’t even be included in measures of government spending to begin with. They’re justifiable as long as the return on those investments – a more educated and productive workforce, and a more efficient infrastructure, both generating more and better goods and services with fewer scarce resources – is higher than the cost of those investments.

In fact, we’d be nuts not to make these investments under these circumstances. No sane family equates spending on vacations with investing in their kids’ education. Yet that’s what we do in our federal budget."I'm not sure about "shouldn't be included in measure of government spending," but they certainly go to show that anyone who wants to rank among rational, informed people should not look at government spending as somehow necessarily bad. Government spending can be good, and more often than not is. Private spending decisions can also be either good or bad ... at least outside the fantasy world of laissez-faire dogma.

Monday, November 12, 2012

Fiscal Conservatism And Necessity

We're in a depression. To many, that's stating the obvious. But it seems not quite everyone realizes just yet.

Our commerce has been significantly below capacity for several years. By the end of 2008 the quarterly output gap exceeded even the previous record (from 1982) for output gaps since 1949. We've seen the main characteristic factors of depression beyond just the raw output gap: increased unemployment, tight credit for consumers and small business, and bank failures (though many of the potential failures were averted). And as anyone familiar with Irving Fisher's work should know, we'd surely have had significant deflation from the paying down of private debts were it not for a series of Fed actions to mitigate deflationary forces.

Deficit hawks ignore the reasons for our deficits in recent years. Depressions increase short-term costs. People out of work utilize the safety net when they wouldn't otherwise. We have a severe short-term increase in costs. At the same time, depressions also reduce revenue. We bring in less tax money because fewer people are getting paid, and often smaller real wages.

There's one clear answer to get rid of deficits: get people back to work. Rev up the economy back to potential. Close the output gap. Until we do that, we'll continue to have increased costs and reduced revenues.

In our attempts to close that output gap, today's fiscal conservatives hamstring us with massive state budget cuts to avoid the temporary tax increases and/or bond issuance needed for dealing with the downturn. Their unwillingness to raise revenue means lots of layoffs, slowing down our economy while hurting the quality of services that we the people want. Many of us would willingly pay more in taxes to keep quality of service through an economic downturn. Many of us would be more than willing to pay more in taxes to keep investing in the sort of growth-spurring government measures that can get us back to expansion. But fiscal conservatives will brook no such sensibility. So instead we get slower growth and less prosperity. Like our slow recovery? Thank a fiscal conservative. Like our rising tuition costs for students? Thank a fiscal conservative. Like our broken roads increasing business costs? Thank a fiscal conservative. Like fewer research patents being licensed to domestic businesses than we'd otherwise have over the coming years? Thank a conservative.

This impact is nothing new. We had deficit hawks and credit growth hawks to thank for the recession of 1937-38 when attempts to balance the budget and tighten monetary policy put a crimp in recovery from the Great Depression. We had sharp cuts in the name of balanced budget zeal to thank for the recessions and increased unemployment under Eisenhower. Time and again, we keep having to re-learn the lesson that sharp cuts hurt even when they're earnestly meant to help.

We're long overdue to stop letting fiscal conservatives shape the narrative. We need to stop worrying about balancing the budget when we're in the midst of a downturn. When the economy's roaring at full steam, then we can afford to mess about with budget balancing. Until then, we can't afford their cuts.

One needs to already be in good shape to recover from a deep, large, sharp cut. Until we've eliminated the output gap, we need more recovery efforts ... not more cuts.

|

| GDP depressed below normal levels from 2008 through this writing |

Deficit hawks ignore the reasons for our deficits in recent years. Depressions increase short-term costs. People out of work utilize the safety net when they wouldn't otherwise. We have a severe short-term increase in costs. At the same time, depressions also reduce revenue. We bring in less tax money because fewer people are getting paid, and often smaller real wages.

There's one clear answer to get rid of deficits: get people back to work. Rev up the economy back to potential. Close the output gap. Until we do that, we'll continue to have increased costs and reduced revenues.

In our attempts to close that output gap, today's fiscal conservatives hamstring us with massive state budget cuts to avoid the temporary tax increases and/or bond issuance needed for dealing with the downturn. Their unwillingness to raise revenue means lots of layoffs, slowing down our economy while hurting the quality of services that we the people want. Many of us would willingly pay more in taxes to keep quality of service through an economic downturn. Many of us would be more than willing to pay more in taxes to keep investing in the sort of growth-spurring government measures that can get us back to expansion. But fiscal conservatives will brook no such sensibility. So instead we get slower growth and less prosperity. Like our slow recovery? Thank a fiscal conservative. Like our rising tuition costs for students? Thank a fiscal conservative. Like our broken roads increasing business costs? Thank a fiscal conservative. Like fewer research patents being licensed to domestic businesses than we'd otherwise have over the coming years? Thank a conservative.

This impact is nothing new. We had deficit hawks and credit growth hawks to thank for the recession of 1937-38 when attempts to balance the budget and tighten monetary policy put a crimp in recovery from the Great Depression. We had sharp cuts in the name of balanced budget zeal to thank for the recessions and increased unemployment under Eisenhower. Time and again, we keep having to re-learn the lesson that sharp cuts hurt even when they're earnestly meant to help.

We're long overdue to stop letting fiscal conservatives shape the narrative. We need to stop worrying about balancing the budget when we're in the midst of a downturn. When the economy's roaring at full steam, then we can afford to mess about with budget balancing. Until then, we can't afford their cuts.

One needs to already be in good shape to recover from a deep, large, sharp cut. Until we've eliminated the output gap, we need more recovery efforts ... not more cuts.

Labels:

conservative,

debt,

deficit,

deflation,

depression,

economy,

fiscal conservatism,

output gap,

recovery,

revenue,

unemployment

Friday, November 9, 2012

In the Wake of the Election, Can the GOP Face Reality?

David Frum, former economic speechwriter for President George W. Bush, says that the GOP has, "been fleeced, exploited, and lied to by a conservative entertainment complex".

Tuesday, November 6, 2012

The Real Threat to Capitalism

Mark Thoma on the real threat to capitalism:

"Free-market advocates fear creeping socialism, but too much inequality is presently a much bigger threat to the capitalist system."Maintaining a balance is much easier when one recognizes that it's possible to veer off the road on either side rather than in just one way.

Monday, November 5, 2012

Echo Chambers and Ideologues

Among the things that have been made clear to many this election season: quite a few folks out there are listening to an array of sources that echo each other without any solid grounds for what they say. And many of those folks are taking the seeing of that echo reflected on the many sites as if it were proof that what's echoing around those sites were true. Meanwhile, many have begun to wrongly dismiss as "biased" even the most reputable sources that would disagree with their preferred beliefs ... merely because those reputable sources challenge certain preconceptions.

For instance, challenge a climate change denier and one is likely only to encourage them to even more thoroughly embrace others who are likewise making similar claims in denial. Perhaps that's the true secret of success behind the growth of the right-wing sources.

In "Chart of the Day: The Power of the Right-Wing Echo Chamber", Kevin Drum explores a chart that demonstrates the effect of this tendency regarding job numbers. It begs the question: among those who are listening to this "echo chamber", what could possibly shake them from those among their beliefs that can be dis-proven? When proof just leads to ever more vociferous rejection, what can bring re-evaluation of those preconceptions?

While the truth tends to rest somewhere in the middle, that can only be so when the sides are balanced. Once one side abandons its extreme for that middle where the truth lies, the truth doesn't shift to the new middle between the side that held fast and the side that moved to the truth. But how can we shake loose a side that persistently rejects the true middle?

For instance, challenge a climate change denier and one is likely only to encourage them to even more thoroughly embrace others who are likewise making similar claims in denial. Perhaps that's the true secret of success behind the growth of the right-wing sources.

In "Chart of the Day: The Power of the Right-Wing Echo Chamber", Kevin Drum explores a chart that demonstrates the effect of this tendency regarding job numbers. It begs the question: among those who are listening to this "echo chamber", what could possibly shake them from those among their beliefs that can be dis-proven? When proof just leads to ever more vociferous rejection, what can bring re-evaluation of those preconceptions?

While the truth tends to rest somewhere in the middle, that can only be so when the sides are balanced. Once one side abandons its extreme for that middle where the truth lies, the truth doesn't shift to the new middle between the side that held fast and the side that moved to the truth. But how can we shake loose a side that persistently rejects the true middle?

Sunday, November 4, 2012

And The Economist Endorsement Goes To ...

The Economist may not be especially cheerful about the election:

But nonetheless The Economist has issued an endorsement for President Obama, even if mainly because "Mr Romney has an economic plan that works only if you don’t believe most of what he says".

"FOUR years ago, The Economist endorsed Barack Obama for the White House with enthusiasm. So did millions of voters. Next week Americans will trudge to the polls far less hopefully. So (in spirit at least) will this London-based newspaper. Having endured a miserably negative campaign, the world’s most powerful country now has a much more difficult decision to make than it faced four years ago."Of course, some would say we shouldn't expect cheerful enthusiasm to be the norm from a publication named for "the dismal science".

But nonetheless The Economist has issued an endorsement for President Obama, even if mainly because "Mr Romney has an economic plan that works only if you don’t believe most of what he says".

Thursday, October 25, 2012

Colin Powell On The Election And His Remaining A Republican

From "Colin Powell endorses Barack Obama for president",

"'The major problem faced either by Gov. Romney or President Obama, whoever wins the election, is going to be what to do about the fiscal cliff we're about to fly over,' Powell said.

'This is something that was put in place by Congress and while we're talking about the two candidates for president let's not forget that Congress bears a lot of responsibility for many of the problems that we have now. ... '"and

"And, despite his endorsement of a Democratic candidate in two presidential elections, Powell says he remains a Republican. 'I think I'm a Republican of a more moderate mold," he said before adding, "That's something of a dying breed I'm sorry to say.'"

Labels:

Congress,

fiscal cliff,

Powell,

Republican

Wednesday, October 24, 2012

Money and Toasters: Value As Real As Any Other

Steve Williamson sparked some exposition on the value of money by claiming, "Money, for example, is a pure bubble, as its fundamental is zero." This can reasonably be interpreted, as Noah Smith did, as claiming that "money is just little green pieces of paper!" Noah's excellent instinct was, of course, to reject that idea.

In the grand scheme of things, it's at least as true to claim that the fundamental of anything whatsoever is zero as it is to make that claim for money. Gold? It's shiny and all that. Oh, and it's supply is relatively limited. But there's no absolute necessity that we place a certain value on things that are shiny and available in limited supply. Gold has exchange value because people are interested in accumulating it and ultimately for no other reason. Stocks in companies? They have value only because we expect that company to continue to have a certain level of profit and thus make the stock redeemable for something. But in ever case, it's the same root. It doesn't matter what we substitute. The exchange value of every single thing depends on what people believe to be the exchange value of that thing. Yet many think that there's some special magic to gold that makes little shiny bits of a certain metal inherently more valuable than little, intricate, artfully printed, green pieces of paper.

Sadly, no discussion is likely to change the opinion of the steadfast phobic of "fiat currency". However, for the rest of us, we can at least enjoy the entertainment value of some turns of phrase on the matter.

From Noah Smith's "Money is just little green pieces of paper!",

And from Paul Krugman's "Things That Aren’t Bubbles", though there's a lamentable lack of toaster references and nothing about the chickens, there's a point that ought to be the finale for anyone who is working from logic rather than preconceptions,

In the grand scheme of things, it's at least as true to claim that the fundamental of anything whatsoever is zero as it is to make that claim for money. Gold? It's shiny and all that. Oh, and it's supply is relatively limited. But there's no absolute necessity that we place a certain value on things that are shiny and available in limited supply. Gold has exchange value because people are interested in accumulating it and ultimately for no other reason. Stocks in companies? They have value only because we expect that company to continue to have a certain level of profit and thus make the stock redeemable for something. But in ever case, it's the same root. It doesn't matter what we substitute. The exchange value of every single thing depends on what people believe to be the exchange value of that thing. Yet many think that there's some special magic to gold that makes little shiny bits of a certain metal inherently more valuable than little, intricate, artfully printed, green pieces of paper.

Sadly, no discussion is likely to change the opinion of the steadfast phobic of "fiat currency". However, for the rest of us, we can at least enjoy the entertainment value of some turns of phrase on the matter.

From Noah Smith's "Money is just little green pieces of paper!",

"So what is 'fundamental value'? Is it consumption value? If that's the case, then a toaster has zero fundamental value, since you can't eat a toaster (OK, you can fling it at the heads of your enemies, but let's ignore that possibility for now). A toaster's value is simply that it has the capability to make toast, which is what you actually want to consume"From Brad DeLong's "Noah Smith's Sanity Requires That He Stop Reading Steve Williamson: Foundations Of Monetary Theory Weblogging,

"A toaster has fundamental value because it performs the useful service of making toast. Money has a fundamental value because it performs the useful service of enabling transactions."and

"Perhaps what Williamson might mean by 'money is a bubble' is: 'while money is not a bubble, the government can drive the value of money to zero by printing near-infinite amounts of it'. While this is true, it is not very interesting: the government could, after all, drive the value of toasters to zero by manufacturing near-infinite quantities of them as well."and chickens. He found a way to work chickens into it too. Let's not forget about the chickens.

And from Paul Krugman's "Things That Aren’t Bubbles", though there's a lamentable lack of toaster references and nothing about the chickens, there's a point that ought to be the finale for anyone who is working from logic rather than preconceptions,

"In each case what people are missing is that value is an emergent property, not an essence: money, and actually everything, has a market value based on the role it plays in our economy — full stop."If by some meltdown we ever were to reach a point where people no longer recognize a value to money, it would be because we had bigger problems than merely whether money has value. That may be the biggest thing missed by those folks who worry about the value of "fiat currency". If we ever reached that point, gold wouldn't likely do much good either. For that matter, unless they're solar or wind-up, toasters might not either. Chickens? Well, they are tasty.

Tuesday, October 23, 2012

Russia a Rival or Partner, Not a "Foe"

While this forum seeks to avoid specific endorsements to vote for a particular candidate, it's fair to say that there are certain statements that should clearly rule out the election of a candidate. It's the sort of thing that leaves one wondering, "what was he thinking?"

Not for the first time, having previously said similar things, in the third 2012 Presidential debate Mr. Romney said,

"First of all, Russia, I indicated, is a geopolitical foe ..."Presuming he's not confused as to what "is" means, perhaps Mr. Romney is unclear on the meaning of "foe". Merriam-Webster defines foe as

- one who has personal enmity for another

- an enemy in war

- one who opposes in principle

- something prejudicial or injurious

That's very harsh language. As he's repeatedly stated that they're our foe, the only way it could have been an accident is if he just doesn't understand the meaning of the term. Assuming that he has some idea what he's saying then according to Mr. Romney's choice of term, he essentially claims that either there's hatred between our nations, that we're at war, that we're directly opposed as a matter of principle, or that they're actively hurting us. Mr. Romney is, of course, wrong. Quite thoroughly wrong. Un-Presidentially, ineptly, dangerously wrong.

Granted, relations with Russia are sometimes tense. Granted, our nations historically were foes of each other at certain points in our history. But the same could be said for many of our modern allies, such as Germany and the United Kingdom. That would be no excuse for calling them foes today.

Russia today is our geopolitical rival in many ways. In other ways it our geopolitical partner. We compete with Russia for influence over various nations that are important to both nations in trade. That makes us rivals, not foes. Russia recently allowed us to pass supplies through their territory and worked with us on joint counter-terrorism and counter-piracy efforts. That makes us sometimes partners, not foes.

Romney attempts to excuse his declaration by saying,

"Russia does continue to battle us in the U.N. time and time again. I have clear eyes on this. I'm not going to wear rose-colored glasses when it comes to Russia or Mr. Putin ..."If one wishes to avoid wearing rose-colored glasses about a village facing a harsh winter, one does not set fire to the village. That Russia doesn't agree with us about everything in the United Nation just makes them a different nation with interests that don't always match our own. One can't improve our chances of cooperation in the U.N. by declaring them our foe. We may, however, make them more willing to side with us on issues where there's potential for compromise by engaging in joint efforts against our real, mutual foes: terrorists and pirates ... as we have done recently.

One builds an ally through efforts to work together. One builds foes through setting oneself against potential foes. Mitt Romney told us loud and clear what he would do for the United States. He would build us an array of foes. That would hurt us in trade. That would hurt us in treaties. Mitt Romney clearly represents the wrong direction for America in the world.

Monday, October 22, 2012

Shall We Restore our Cavalry Numbers?

President Obama during the final 2012 Presidential debate:

"You mention the Navy, for example, and the fact that we have fewer ships than we did in 1916. Well governor, we also have fewer horses and bayonets ... because the nature of our military has changed. We have these things called aircraft carriers where planes land on them. We have ships that go underwater, nuclear submarines."

Friday, October 19, 2012

Not All Tax Cuts Are Created Equal

From "Tax Cuts for Job Creators" by Laura D’Andrea Tyson and Owen Zidar:

"... if the priority is to create a substantial number of jobs over the next presidential term, evidence from the last half-century strongly suggests that tax cuts for the top 5 percent won’t work. Tax cuts for working families, tax cuts directly aimed at expanded hiring or increases in infrastructure investment would have much more bang for the buck and would cost much less in terms of forgone revenue and deficit reduction in the future."If we can't talk enough people out of some kind of tax cut despite that taxes are unusually low by modern historic standards, it should at least be the relatively sensible tax cuts for the lower 95% instead of the entirely senseless tax cuts for the top 5%.

Wednesday, October 17, 2012

Government and Job Creation: Where Both Candidates Got It Wrong (Although One More So), Government Does Create Jobs

No binders involved in this jobs question, not even Mitt's "binders full of women" for filling state cabinet positions. In the Presidential debate last night neither of the Presidential candidates got it right on government and job creation. One, of course, was more wrong than the other ... but neither got it right.

No binders involved in this jobs question, not even Mitt's "binders full of women" for filling state cabinet positions. In the Presidential debate last night neither of the Presidential candidates got it right on government and job creation. One, of course, was more wrong than the other ... but neither got it right.Mr. Romney:

"Government does not create jobs. Government does not create jobs. (Chuckles.)"President Obama (in response to "What do you believe is the biggest misperception that the American people have about you as a man and a candidate?"):

"... a lot of this campaign, maybe over the last four years, has been devoted to this notion that I think government creates jobs, that that somehow is the answer. That's not what I believe.

I believe that the free enterprise system is the greatest engine of prosperity the world's ever known. I believe in self-reliance and individual initiative and risk-takers being rewarded. But I also believe that everybody should have a fair shot and everybody should do their fair share and everybody should play by the same rules, because that's how our economy is grown. That's how we built the world's greatest middle class."Given his relatively conservative budget policy and restraint -- arguably ambivalence -- on fiscal stimulus, it seems plausible that the President really doesn't get that government can create jobs. Sure, he could have just been playing to conservatives, but his actual record suggests he really meant it. He may see more of a role for government in helping free enterprise than his opponent. But that just makes him less wrong. He apparently doesn't particularly believe in fiscal stimulus as a major tool to raise actual GDP towards potential GDP, which shouldn't be surprising to all of the Keynesian economists who called for a much larger, better stimulus and who read the accounts of how we came to get what stimulus we got, mostly without the President seriously pushing for any more. Sure, it might not have been politically feasible to get more, but that was partially because the President wasn't using the bully pulpit to push hard for more. Why? Apparently because he believes the widespread conservative myth that "government does not create jobs".

Despite what the candidates appear to believe, the fact of the matter is clear. Government most certainly can create jobs when actual GDP is significantly below potential GDP. Such as now.

As Dean Baker put it in summing up a different debate, "the Baker-Rowe-DeLong-Krugman Deficit Debate",

"First, we all seem to agree that in a situation where the economy is clearly operating well below its potential, governments can run deficits to boost employment and output. I believe we all agree that in principle the government can also use these deficits to increase future output through productive investment in either physical or human capital. This would make future generations better off on net as a result of deficits today, since the economy will be larger than it would be without the deficits."When the economy is running at capacity, deficit spending generally won't stably boost us above potential. At that point, extra government spending risks crowding out private enterprise and in some cases certainly will do so. We're not at that point. Heck, we're nowhere near that point. The economy is gradually improving, but we've got a long way to go. While we're still plugging an output gap, deficit spending most certainly can and does create jobs whereas government cuts directly reduce overall employment.

Yet deficit spending during a downturn just illustrates one of many ways that government can create jobs. Progressive tax rates combined with social safety-net programs mitigate inequality and -- by getting money to those who have more want than means to fulfill it -- increase commerce, both effective and potential. Then there's research and development, for which various estimates show it's just a matter of exactly how many dollars are added to the economy for each dollar we've spent on NASA research that we've patented and licensed out to domestic firms. The only question is the exact multiplier; it's certain that NASA spending (not to mention DARPA and others) has created some number of private enterprise jobs beyond those that would have existed without the space program.

Private enterprise certainly excels at many things and government would be the wrong choice for a number of tasks, especially producing most kinds of manufactured products from MP3s to ice cream. So please don't misconstrue this as suggesting that more government is always better; there's a limit to what government reasonably can be expected to do or should do. President Obama is correct to believe that a major part of government's role consists of working towards creating a level playing field for private enterprise. But like Mr. Romney, he's wrong to fall for the conservative delusion on government and job creation. Government most certainly can create jobs. And right now, even more than usual, we very much need government to stop cutting back and do all that it can to create jobs.

But how do we get these politicians and the general public they serve to understand that?

Tuesday, October 16, 2012

The Progressive Path to Jobs

Steve Roth at Angry Bear yesterday covered similar ground to one of mine from February, "Debunking the Notion that Inequality Wouldn't Impact the Economy". Roth's "GDP, Prosperity, The Wealth Effect, and Marginal Propensity to Consume", took a slightly different track. Whereas I discussed the impact on GDP from inequality of income, Roth looks at inequality of wealth. As of yet, it's hard to say which is the better angle, although as Roth notes, the distinction starts to blur with age, since "people nearing or in retirement start paying a lot more attention to wealth than income." That is, unless you're dealing with folks who have nothing but social security because -- among other possible reasons -- they never had high enough disposable income to put anything aside.

Either way, whether income or wealth is the more important factor, clearly inequality matters. It impacts our commerce, our GDP. At least so long as the people at the middle (let alone the bottom) have wants and needs they can't fulfill for lack of means, a reduction in inequality achieved with the effect of getting more means to those who will use it will increase GDP and general prosperity. Ironically, spreading the wealth around a bit should lead to more potential for our economy to support more wealth. [Caveat: of course, we shouldn't go overboard. Just more equitable ... not perfectly even.]

And by progressive policies leading to more equitable distribution, that would constitute a way that -- contrary to what both candidates said or implied in tonight's debate -- government most certainly can create jobs. What leads to more commerce generally leads to more jobs, and a more equitable distribution would mean more commerce.

Either way, whether income or wealth is the more important factor, clearly inequality matters. It impacts our commerce, our GDP. At least so long as the people at the middle (let alone the bottom) have wants and needs they can't fulfill for lack of means, a reduction in inequality achieved with the effect of getting more means to those who will use it will increase GDP and general prosperity. Ironically, spreading the wealth around a bit should lead to more potential for our economy to support more wealth. [Caveat: of course, we shouldn't go overboard. Just more equitable ... not perfectly even.]

And by progressive policies leading to more equitable distribution, that would constitute a way that -- contrary to what both candidates said or implied in tonight's debate -- government most certainly can create jobs. What leads to more commerce generally leads to more jobs, and a more equitable distribution would mean more commerce.

Monday, October 15, 2012

A More Important Deficit: The Jobs Deficit

Yes, the jobs scene is getting better. But it's obviously not back where it should be yet, and for more than one reason.

From "Closing America’s Jobs Deficit", Laura Tyson reports that

And what is a certain party calling for? More contractionary fiscal policy.

Tyson also note some interesting points about the jobs that are out there, the differences in unemployment for those with less education versus those with more education, and that:

From "Closing America’s Jobs Deficit", Laura Tyson reports that

"Public-sector demand has also contracted, owing to state and local governments’ deteriorating budgets. As a result, public employment, which usually rises during recoveries, has been a major contributor to high unemployment during the last three years. Despite a modest uptick in the last three months, government employment is 569,000 below its June 2009 level – a 30-year low as a share of the adult civilian population. According to Hamilton Project calculations, if this share were at its 1980-2012 average of about 9.6% (it was actually higher between 2001 and 2007), there would be about 1.4 million more public-sector jobs and the unemployment rate would be around 6.9%."This may not be stunning news to those of us who've already been lamenting that aspect of layoffs stunting our recovery, but it's certainly worth highlighting again ... especially that we would have an unemployment rate somewhere around a full point lower if it weren't for the public sector layoffs. Obviously, if it weren't for contractionary fiscal policy (govt budget cuts), we'd have a far better employment situation.

And what is a certain party calling for? More contractionary fiscal policy.

Tyson also note some interesting points about the jobs that are out there, the differences in unemployment for those with less education versus those with more education, and that:

"... recent study by McKinsey suggests that the gaps in educational opportunity and attainment by income impose the equivalent of a permanent recession of 3-5% of GDP on the US economy."

Labels:

jobs,

public payrolls,

unemployment

Friday, October 12, 2012

The "Burden of Debt" versus the Burden of a Weak Economy

Dean Baker from "Brad Delong Beats Me To Responding to Nick Rowe":

"... The burden of the debt only exists if there is reason to believe that debt is somehow displacing investment in private capital, which is certainly not true at present.

I would probably argue the case even more strongly. In a depressed economy like we have today, there is reason to believe that the deficit, by boosting demand, is actually increasing investment, thereby making future generations wealthier. There is also the issue of human capital, that by keeping workers employed and keeping families intact, it is improving the productive capacities of the labor force in the future.

Perhaps most importantly,it is essential that people understand that the measure of the burden of the debt in future generations is not the size of the debt, but the extent to which we believe the debt has reduced output in the future compared to a counter-factual where we did not run the debt. If the debt did not reduce the economies' future productive capabilities (or even raised them) then there is no burden of the debt. In any case, how well we are treating our children is measured first and foremost by the health and the economy and the society we pass on to them, not the amount of government debt."

(Emphasis added by me)

This is part of why it makes sense to put deficit spending into fixing the output gap. While the economy is rolling, it's rolling slower than it ought to be. If we use deficit spending to push our economy up to its potential, we pass on a more healthy economy to our children.

(For other related comments, see Mark Thoma's "Bogus Arguments about the Burden of the Debt")

And the reverse also holds. In a depressed economy, austerity should shrink what we're handing to our children. Apparently the IMF is starting to learn that lesson about Europe, though as Krugman points out, the GOP seems not to have caught on to the lesson.

Labels:

debt,

deficit,

economy,

output gap,

spending

Thursday, October 11, 2012

How Famous People Become Associated With Phrases In Searches: Romney and "Completely Wrong"

Today's lesson in how things happen on the Internet: just because a picture comes up in a Google search for some embarrassing phrase doesn't mean that folks are manipulating search algorithms to make that person look bad.

|

| Could it be because he said the phrase? |

In fact, it might just mean that the person's famous and in a recent statement said that phrase. Like, oh, maybe admitting to being "completely wrong" about something. And the media thought that was a big deal and put the phrase in a bunch of headlines of stories that included the person's image. And a large number of web sites linked to those stories about the use of the phrase by that person.

Voila! Suddenly an image search for the phrase brings up the images of a famous person whose saying of that phrase became very, very public. That's how it works. No manipulation; just fame.

But then for bonus points, articles written by various reporters who've been tasked with churning out something about the phenomenon but don't have much time to research or understanding of how it works will swoop in. It sounds all technical and they're not sure how it happened, so they'll write up stories talking about manipulation of search algorithms figuring surely that would explain it ... after all, they don't know how it happened. Never mind Occam's razor and that there's a more simple explanation that comes up in the non-image search results, at least before reporters start writing about the phenomenon of the search results.

Labels:

completely wrong,

Google,

Internet,

Romney

Wednesday, October 10, 2012

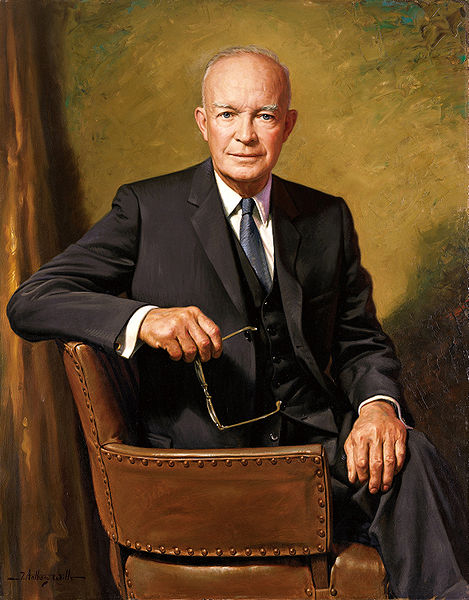

Dwight D Eisenhower, A Proud But Mixed Legacy

President Eisenhower, as quoted in the 1956 Republican Party Platform, gives a rousing call for shared prosperity, cooperation, and balancing logic with empathy:

President Eisenhower, as quoted in the 1956 Republican Party Platform, gives a rousing call for shared prosperity, cooperation, and balancing logic with empathy:"The individual is of supreme importance.Here was a Republican who expanded Social Security, accelerated desegregation of the armed forces, proposed and ultimately signed important civil rights legislation, and derided those like today's Republican leadership who would threaten the social safety net. It's well known that he wrote,

The spirit of our people is the strength of our nation.

America does not prosper unless all Americans prosper.

Government must have a heart as well as a head.

Courage in principle, cooperation in practice make freedom positive.

To stay free, we must stay strong."1

"Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H. L. Hunt (you possibly know his background), a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid."2

However, while it's rarely mentioned alongside this popular quote, President Eisenhower was writing in response to his brother Edgar, who had accused him of pursuing the same policies in foreign relations and many domestic policies as the previous administration, that of Democrat Harry Truman. In context, it would appear that President Eisenhower's reasons for defending the pursuit of those programs had little or in some cases perhaps even nothing whatsoever to do with whether or not he believed in their being wholly good programs. Rather, as he wrote in that same letter, "the Federal government cannot avoid or escape responsibilities which the mass of the people firmly believe should be undertaken by it"2. The point was that the people believe those programs to be the proper business of the government and so it would be folly for him to end the programs demanded by the people. It was not necessarily that he personally agreed with all of the programs, it was that he was a representative of a people whom he knew to have given him no mandate to end any of those safety net programs.

However, while it's rarely mentioned alongside this popular quote, President Eisenhower was writing in response to his brother Edgar, who had accused him of pursuing the same policies in foreign relations and many domestic policies as the previous administration, that of Democrat Harry Truman. In context, it would appear that President Eisenhower's reasons for defending the pursuit of those programs had little or in some cases perhaps even nothing whatsoever to do with whether or not he believed in their being wholly good programs. Rather, as he wrote in that same letter, "the Federal government cannot avoid or escape responsibilities which the mass of the people firmly believe should be undertaken by it"2. The point was that the people believe those programs to be the proper business of the government and so it would be folly for him to end the programs demanded by the people. It was not necessarily that he personally agreed with all of the programs, it was that he was a representative of a people whom he knew to have given him no mandate to end any of those safety net programs.It is clear that President Eisenhower supported some (if not all) safety net programs. For instance, in his 1953 State of the Union address to Congress, he included a recognition of the need for at least certain social services and safeguards.

"This administration is profoundly aware of two great needs born of our living in a complex industrial economy. First, the individual citizen must have safeguards against personal disaster inflicted by forces beyond his control; second, the welfare of the people demands effective and economical performance by the Government of certain indispensable social services."3It's also clear that his budgets put federal money where his mouth was in that regard, as the frequent cuts through his first term mainly hit the defense sections while social security steadily grew. Those reductions in defense spending bring to mind another of his famous quotes from the Chance for Peace speech,

"Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone.

It is spending the sweat of its laborers, the genius of its scientists, the hopes of its children."4Even through his second term, while defense spending returned to rising, by the time of his final budget defense spending still had not returned to the level of his first budget. This lowered spending suggests that he really meant it and worked to avoid spending more than he felt was necessary ... so as to avoid committing even more "theft from those who hunger and are not fed". However, like so many quotes from times past, one could easily read too much into President Eisenhower's lamenting of the resources spent on the military. Remember, this was a retired general speaking. He wasn't about to unilaterally disarm while others didn't. Nor would he likely have accepted such a massive reduction in forces that our ability to respond to unanticipated threats would be crippled. Instead, he only hoped to reach agreement with opposing powers that would reduce the scale of military spending with potential aspects such as, "limitation, by absolute numbers or by an agreed international ratio, of the sizes of the military and security forces of all nations."4 One can not properly read an opposition to all military spending into this retired general's statement. On the contrary, he later wrote in a letter,

"My great difficulty is in realizing that anyone in this country, even for partisan reasons, would entertain for a moment the thought that I would let our defense structure be undermined to a danger point. What I am trying to do is to keep a clearly adequate security and our economy sound, preserving the integrity of our dollar both at home and abroad. At the same time we must not drain off from our economy so much money in taxes that we diminish too markedly the private funds needed for expansion."5Clearly he was not universally opposed to military spending but rather concerned with prudent allocation, i.e. with not allowing unconstrained military spending to swallow up too large a portion of our resources.

"Our problem is to achieve adequate military strength within the limits of endurable strain upon our economy. To amass military power without regard to our economic capacity would be to defend ourselves against one kind of disaster by inviting another."3It was not a cut at all costs imperative, as he acknowledged the value of some military and social spending, "balancing the budget is not so important as the performance of those governmental functions that are designed to sustain our security and promote economic development."6 But like today's laissez-faire proponents, he believed that money spent by the government would drain off our economy and diminish the private sector. And like today's inflation hawks, he believed that "a rash of spending ... would encourage inflation".7 And conversely he believed that restraining spending would "do much to sustain the integrity and purchasing power of our dollar".8 He considered deficits "one of the inciting causes" of inflation.8 Reading Eisenhower's various comments on balancing the budget, one is struck by how similar his reasoning is to conservatives of later years except that he stressed the importance of reducing spending before reducing taxes,9 whereas current Republicans are willing to reverse that order.

Unfortunately for President Eisenhower's economic legacy, his budget cuts were not without costs of their own. Inflation-adjusted median income grew by just 1.83% from 1953 to 1960 as opposed to the 9.17% from 1947 (start of available data) to 1952 under Truman or the 20.08% from 1961 to 1968 under Kennedy/Johnson.10 And unemployment under his watch rose from 2.6% to 6.9%. While he did manage multiple balanced budgets with his fiscal restraint, he did so to the detriment of the economy that he sought to improve.

Sources:

- 1956 Republican Party Platform

- http://www.eisenhowermemorial.org/presidential-papers/first-term/documents/1147.cfm

- 1953 State of the Union address to Congress

- Chance for Peace

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1107.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/497.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1114.cfm

- http://www.eisenhowermemorial.org/presidential-papers/second-term/documents/1042.cfm

- http://www.eisenhowermemorial.org/presidential-papers/first-term/documents/279.cfm

- https://www.census.gov/hhes/www/income/data/historical/people/2011/P04_2011.xls

Monday, October 8, 2012

Standard Course, For a Financial Crisis

For today, just a link: "Fact-checking Financial Recessions", essentially showing that we're on the standard course of a financial crisis.

Sunday, October 7, 2012

Baumol's Speaking To Him; Sadly, Ryan Doesn't Seem To Be Listening

The NY Times' Amy Wallace gives a glimpse of Professor Baumol's "The Cost Disease: Why Computers Get Cheaper and Health Care Doesn’t" in her review:

"As the cost of health care continues to be a battering ram in the 2012 presidential campaign, Professor Baumol’s seemingly academic treatise contains a couple of zingers that one can imagine President Obama incorporating into his stump speech. The future is bright, this book argues, as long as policy makers don’t do things that are sure to bring on the storm clouds.

“The very definition of rising productivity ensures that the future will offer us a cornucopia of desirable services and abundant products,” he writes. “The main threat to this happy prospect is the illusion that society cannot afford them, with resulting political developments — such as calls for reduced government revenues entwined with demands that budgets be in balance — that deny these benefits to our descendants.”

Are you listening, Paul Ryan? Because Professor Baumol seems to be talking directly to you."Certainly a relevant book for one of the main decisions facing this electorate. Sadly, Ryan doesn't seem to be listening.

Unemployment and Party Policies: There's a Correlation, But What's the Causation?

Can we conclude failed / succeeded party policies from the following chart? Or did the policies change too much from administration to administration even within parties to attribute this trend to a policy set typical of either party?

This being unemployment, down is good ... a reduction in unemployment. The chart starts with the first President whose full term is entirely within the standard BLS/FRED "unrate" data. Figures are calculated by starting with the first full month of the administration and going to the first full month of the next administration or to the latest available month in the case of the current administration.

As a group since Eisenhower, Republican Presidents averaged a 2.05 point increase in unemployment per administration. Meanwhile Democrats averaged a 1.42 point reduction in unemployment per administration.

From all that I've seen beyond just this chart, I'm tempted to say that this chart illustrates the economic impact mainly of two things: Republican drives to cut spending to balance the budget and Democratic drives to strengthen the safety net resulting in more fuel to the consumer engine. However, I hesitate to state that as a definitive explanation at this point. It's more of a rough hypothesis.

Labels:

Democrat,

President,

Republican,

unemployment

Saturday, October 6, 2012

Encouraging Signs in Govt Payrolls ... For Now

Bill McBride of Calculated Risk comments on a number of encouraging signs in the economy in "Employment: Somewhat Better (also more graphs)",

"It appears most of the state and local government layoffs are over.Sure. But there's a big "if" in the looming fiscal cliff from the budget sequestration. We're at a point where the economy might be more or less ready to start more seriously improving towards potential despite insufficient fiscal policy remediation. Yet we've got looming massive budget cuts that could tip us into a nosedive if Congress doesn't come to realize we've got more to fear from massive cuts than from short term deficits.

Overall this was a somewhat more encouraging report."

Friday, October 5, 2012

The Cost of Balanced Budgets and a Longer View on Presidents and Jobs From Ike To 2012

I'd usually heard the 50s described as more or less a golden era of rising prosperity. But till recently I tended to skip over digging into that decade's economic data to focus on the Great Depression up through World War II (when not mucking about the peaks and valleys of more recent times). So I have to admit this chart surprised me.

I was expecting that adding in the Republican Presidents before Reagan would show that prior to Trickle-down / Supply-side economics / Reaganomics infecting the Republican party, they'd done better. I expected to be illustrating the post-Depression glory days of the Republican party via Ike, Nixon, and Ford. Instead, the data gave me what we see above. In jobs, Nixon and Ford both did worse than Johnson, Carter, and Clinton. While Nixon and Ford did better than Obama's marks for his full term so far, they each did worse than during his tepid recovery span from February 2010 on to the latest data. And then there's Ike -- whom we admire -- down there with the likes of the Bushes. I didn't want to see that. Frankly, I wanted to believe Ike pulled off the Clinton trick of balancing the budget while improving employment. But I can't deny the data.

If we look a bit further back, before the dates in the data used above to put payroll growth in perspective via population growth, we can at least compare Ike's raw payroll figures to those from FDR (since 1939) and Truman, but that only rules out claiming Ike's dismal jobs performance as part of a longer trend.

It's not a pretty picture for Ike, which I'm sad to see. Thankfully there's still much to admire from President Eisenhower in the highway system and his work for civil rights. I still like Ike. I still think I'd have voted for him if I'd been old enough at the time. But his economic record is tarnished.

In his defense, President Eisenhower did start his term with a 2.6% unemployment rate during that first full month. It's hard to improve on 2.6% unemployment. Still, unemployment rose dramatically to 6.9% by the first full month of his successor's term. Ike's shift: +165% unemployment. That's a rather lousy fumble. And while the Eisenhower years saw increasing family incomes, the same can be said for the Kennedy / Johnson years except without the rising unemployment, as over the course of their span they reduced that rate from the 6.9% that Eisenhower left them back down to 3.4% by the end of Johnson's Presidency.

So what went wrong? Let's look at the modern history of balanced budgets:

In case after case, budgets balanced with spending cuts have brought on recession. And now the Republicans are once again pushing us to balance the budget with dramatic spending cuts. Democrats may not be leading the charge, but Obama like FDR is far too willing to accept the Republican push for cuts. If we don't turn away from this push to slash budgets, previous experience shows us it will hurt the economy. When we make the debt more manageable by growing our economy such that the debt shrinks by comparison, that's tended to work out well. When we clumsily attempt to tackle the debt directly by slashing spending to balance the budget in the hopes a primary surplus, the records shows it tends to work out poorly.

|

| starting with Ike, the first President fully covered in the monthly POP data; to June 2012 |

If we look a bit further back, before the dates in the data used above to put payroll growth in perspective via population growth, we can at least compare Ike's raw payroll figures to those from FDR (since 1939) and Truman, but that only rules out claiming Ike's dismal jobs performance as part of a longer trend.

|

| Ike's sad job numbers with context: at least he's not Bush II |

It's not a pretty picture for Ike, which I'm sad to see. Thankfully there's still much to admire from President Eisenhower in the highway system and his work for civil rights. I still like Ike. I still think I'd have voted for him if I'd been old enough at the time. But his economic record is tarnished.

In his defense, President Eisenhower did start his term with a 2.6% unemployment rate during that first full month. It's hard to improve on 2.6% unemployment. Still, unemployment rose dramatically to 6.9% by the first full month of his successor's term. Ike's shift: +165% unemployment. That's a rather lousy fumble. And while the Eisenhower years saw increasing family incomes, the same can be said for the Kennedy / Johnson years except without the rising unemployment, as over the course of their span they reduced that rate from the 6.9% that Eisenhower left them back down to 3.4% by the end of Johnson's Presidency.

So what went wrong? Let's look at the modern history of balanced budgets:

- At Republican urging, FDR tried to balance the budget with spending cuts and it brought us the Recession of 1937-38.

- After World War II we saw dramatic cutbacks in spending with balanced budgets in 1947 through 1949 and the recessions in 1945 and 1949. (Of course, the war spending was unsustainable; there was probably no way to avoid recession in the late 1940s.)

- Truman balanced the budget in 1951. But like the later Clinton-era balanced budgets this one was done while expanding federal outlays ... rather swiftly increasing from the 1948 lows. Then after we slowed spending at the end of the Korean War, we got the recession of 1953.

- Eisenhower balanced the budget in 1956 and 1957 and we got the Recession of 1957.

- Eisenhower balanced the budget again in 1960 and we got the Recession of 1960.

- Nixon balanced the budget in 1969 and we got the Recession of 1970.

- While Clinton balanced the budget in 1998 lasting through Bush's first budget in 2001, the balancing in these years was done without reducing the growth of federal outlays but rather through moderate increase of tax rates. As such, this particular instance was thoroughly different from most previous balancing of the budget (except Truman's).

There were also some recessions that didn't correspond to these balanced budgets: the oil shock under Nixon, the extremely high interest rates under Reagan, the S&L crisis under Bush I, the Dot-Com crash under Clinton and Bush II, and the housing/finance crash under Bush II. I'm not suggesting that all recessions are caused by cutting to achieve balanced budgets. However, it would seem that balancing our national budget via cuts -- even if only in inflation-adjusted terms as in 1960 and 1969 -- tends to lead to recession.

The impact of Eisenhower's budget balancing exploits are particularly of interest for its parallel to job losses in the Great Recession. Private payrolls dropped by 2.385 million between August 1957 and June 1958, a 5.26% decline. By comparison, that's just barely below the 5.47% decline during the worst job-loss months of the Great Recession from August 2008 through June 2009. Remember that saying about doing the same thing and expecting different results. If we implement massive cutbacks like Eisenhower with our sequestration fiscal cliff, we can expect yet another massive fall just like the Eisenhower recession ... and we've not climbed far enough back from the jagged rocks as it is.

In case after case, budgets balanced with spending cuts have brought on recession. And now the Republicans are once again pushing us to balance the budget with dramatic spending cuts. Democrats may not be leading the charge, but Obama like FDR is far too willing to accept the Republican push for cuts. If we don't turn away from this push to slash budgets, previous experience shows us it will hurt the economy. When we make the debt more manageable by growing our economy such that the debt shrinks by comparison, that's tended to work out well. When we clumsily attempt to tackle the debt directly by slashing spending to balance the budget in the hopes a primary surplus, the records shows it tends to work out poorly.

Labels:

balanced budget,

cuts,

Eisenhower,

employment,

fiscal cliff,

Great Recession,

jobs,

Obama,

payrolls,

President,

recession,

Republican,

sequestration,

trickle-down

Wednesday, October 3, 2012

Presidents and Jobs (Average Private Payrolls Added Per Month Since Carter)

Given that Republicans are often billed as the pro-business party, shouldn't we find business booming under Republican Presidents? Shouldn't we find payrolls rising significantly from all that business expansion?

For President Reagan, to be fair, we should note that his early years were hurt by the same force that crushed payrolls under President Carter during April through July of 1980: the high rates with which Paul Volcker battled inflation. Double-digit prime interest rates diminished employment under both Presidents Reagan and Carter. While those unusually high interest rates may have been necessary to get control over inflation, those high rates severely slowed expansion and thus hiring. However, that doesn't remove the possibility that President Reagan's descent from Carter's payroll numbers hinted at the start of a Republican trend under Trickle-down policies. After all, the Bush I policies were largely a continuation of the Reagan policies. If we average together the Reagan and Bush I months, together they get 113.3 thousand jobs / month. That's less than either of Carter or Clinton. And it's also less than the rate of increase we've seen since the turn-around on 2/1/2010 under President Obama.

While these figures aren't conclusive proof alone, add them together with a few other factors such as that GDP growth has lagged under the lowest top marginal tax rates. It sure looks like Trickle-down (or Supply-side economic or Reaganomics) failed us in a big way.

Maybe we should stop accepting the notion that talking about lowering taxes and deregulating would actually be business-friendly. Maybe we should instead consider ways to return to the sort of sensible, progressive tax structures we had before Reagan lead us down the road to decline. Instead of calling it red tape, maybe we should consider regulation's value for helping business manage risk, compete on a level playing field, and have more predictable returns. And maybe we should get back to expecting serious infrastructure projects and demanding aggressive investments in our research and development programs to build our avenues for growth.

Notes on methodology: Generally speaking, the January in which the executive transitions from one branch to another will be almost entirely impacted by the outgoing President's policies and not those of the incoming President. As such, the average uses the change in monthly manufacturing payrolls starting with the change from the first full month of the President's term (i.e., from the February that is the first full month to the March thereafter) and going until the first full month after the President's term (i.e., the last change counted is from the January during which the President in question is last in office to the February thereafter). Data from BLS/FRED.

Labels:

Bush,

Carter,

Clinton,

employment,

jobs,

Obama,

payrolls,

President,

private payrolls,

Reagan,

Reaganomics,

recovery,

Supply-side,

trickle-down,

Volcker

Tuesday, October 2, 2012

Noah Smith (and Miles Kimball) on New Classical vs New Keynesian

There might be zingers going around the Presidential campaigns, but there are some good ones going around the macro blogs as well. Noah Smith gives us this one in his "Engineering vs. "Science" in macroeconomics" post:

As my advisor (and Greg Mankiw's advisee) Miles Kimball tweeted today when we discussed this topic: "the 'micro foundations [used by New Classicals are] usually not very serious, they're often more like imaginary engineering than science."

Friday, September 28, 2012

Presidents and Manufacturing

Average manufacturing jobs / month gained or lost for the past half dozen Presidents and since the turn-around on January 2010.

Notes on methodology: Generally speaking, the January in which the executive transitions from one branch to another will be almost entirely impacted by the outgoing President's policies and not those of the incoming President. As such, the average uses the change in monthly manufacturing payrolls starting with the change from the first full month of the President's term (i.e., from the February that is the first full month to the March thereafter) and going until the first full month after the President's term (i.e., the last change counted is from the January during which the President in question is last in office to the February thereafter). Data from BLS/FRED.

Notes on methodology: Generally speaking, the January in which the executive transitions from one branch to another will be almost entirely impacted by the outgoing President's policies and not those of the incoming President. As such, the average uses the change in monthly manufacturing payrolls starting with the change from the first full month of the President's term (i.e., from the February that is the first full month to the March thereafter) and going until the first full month after the President's term (i.e., the last change counted is from the January during which the President in question is last in office to the February thereafter). Data from BLS/FRED.

Mitt and Manufacturing

Rather bold of a guy who made a lot of money closing down (among other things) American manufacturing plants to speak on manufacturing jobs ... too bad it was boldly striding into error.

Thursday, September 27, 2012

Trends in Manufacturing Payrolls

A bit of manufacturing job historical info:

- Peak: 6/1/1979 (shortly before Reaganomics) at 19.553 million manufacturing jobs

- Decline from 6/1/1979 to 2/1/2001 (first full month of Bush II's first term): 2.523 million jobs, a 12.9% drop

- Decline from 2/1/2001 to 2/1/2009 (over the course of Bush II's Presidency): 4.644 million jobs, a 27.3% drop

- Post Bush II floor: 1/1/2010 (less than a year after President Obama sworn in) at 11.458 million jobs

- Increase from 1/1/2010 to 8/1/2012 (turnaround to present): 512 thousand, a 4.5% rise

Labels:

Bush,

jobs,

manufacturing,

Obama,

payrolls,

Reaganomics

But When Did Those Jobs Disappear, Mitt?

The state of industry speaks for itself better than some candidates do. When Mitt Romney in Toledo on the 26th of September, 2012 said, "we see manufacturing jobs disappear", he neglected to mention that most of that disappearing happened during the tenure of a President who implemented the same policies that Romney himself is pushing. He also neglected to mention that under the current President they're not disappearing anymore. Under the current President, we've seen manufacturing jobs grow again.