To break even on employment, we need around 2 or 3% growth in GDP.

"Putting this in our current context we can see that growth has to do two things. First it has to cover, or absorb, growth in the workforce due to population changes. A good rule of thumb in the US is that GDP needs to rise by about 2.5% for unemployment just to stay even with such changes." from "Sticky unemployment – Okun’s Law" by Peter Radford

Our GDP, the amount of goods and services we produce, comes from the amount that is spent on American goods and services ... the supply rises and falls to meet the demand. Of that spending (or demand), private sources (individuals and corporations) spend only a portion of the total that makes up the GDP. The government also spends, and that spending makes up a portion of the total demand for goods and services.

Supply doesn't discriminate. Supply is blind to the source. It doesn't care whether the demand comes from private or public sources. No matter what portion of the demand comes from each, supply doesn't care about anything other than the total. If the total demand rises, supply will meet it and require more workers to do so. If the total demand falls, supply will meet it and require fewer workers to do so.

Government's share of GDP has mostly risen over the years, although not in an exactly straight line. Some hate this fact; but whether you call it positive, negative, or neutral, there it is. Government's shared of GDP has been estimated at

25% (or

even 43.85% by one source) for 2010. For the sake of avoiding any exaggeration of the impact of government spending cuts, let's go with that smaller 25% figure. At 1/4 of GDP, a 10% cut in government spending would mean about a 2.5 % reduction in GDP. Let's simplify the numbers so that is easy to see. Imagine if we had a total GDP of 100 million dollars and 25 million of that were from the government:

100 - (25 * 0.10) = 100 - 2.5 = 97.5

So there you have it, a 10% cut in govt spending would shrink our GDP by 2.5%. Of course, this assumes that what we're cutting is to make up for deficit spending, i.e. govt foreign borrowing. Considering that the main reason there's talk of cutting government spending in the US is to reduce foreign borrowing, that seems a safe assumption. Borrowing brings in money from outside, so a reduction in debt-based spending does not get offset inside the system. If we had a balanced budget and were cutting spending in order to lower taxes, the offset might just be shifted from public to private spending. But that's not where we are. We're looking at cuts to reduce the amount of GDP we cover by bringing in money from outside, which means we'd reduce the total spending in the system, the total demand, the total GDP.

But what does it mean to have a cut in government spending reduce our GDP? This brings us back to that minimum GDP growth of about 2.5% in order to keep employment stable. Estimates vary, but many forecasts for 2011 US GDP growth are around 3%. So if we cut our government budget by about 10%, that'd subtract 2.5% and give us a GDP growth of about 0.5%, which is roughly 2% below the level needed to sustain stable employment. That means we'd have rising unemployment. Of course, rising unemployment lowers payroll tax revenues. Dropping payroll tax revenues increase the deficit. Deficit increases make people think about cutting more from the government spending. See how this could spiral?

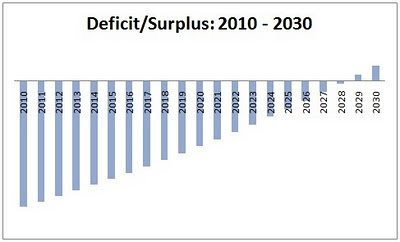

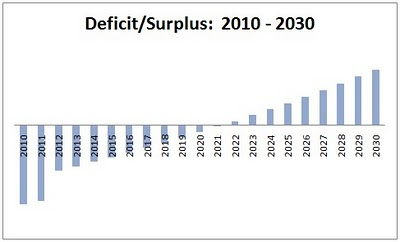

To balance the 2011 budget, we'd need to cut government spending by about

$1.27 trillion. The total spending for 2011 at this point is estimated around

$3.83 trillion. This means that we'd need to cut the budget by around 33% in order to balance revenue with spending.

Assuming the lower 25% share of GDP, thus less impact, a 33% drop in government spending strictly to avoid taking on more debt would slash 8.25% from our GDP.

100 - (25 * 0.33) = 100 - 8.25 = 91.75

|

| Downward spiral |

Pulling 8.25% from our GDP growth would leave us with a GDP growth of around

-5.25 for 2011, which is a severe contraction. Remember that we need around 2.5% growth to keep unemployment stable and higher than that to see a reduction in unemployment. So with a

-5.25% contraction in GDP, unemployment would go up, up, and up some more. That rising unemployment would promptly lower our revenue (and increase our costs for the unemployed) and give us a deficit again. That deficit might make people cut more, which would lower our GDP further and bring more unemployment.

"What you see is that unemployment tends to fall when growth is high, rise when it’s low or negative. You also see that growth has to be fairly fast — more than 2 percent — just to keep the unemployment rate from rising. Why? Well, productivity is rising, so that you can produce any given level of output with fewer workers; so output has to rise to keep employment from falling. And the working-age population is growing, so you need positive employment growth just to keep unemployment from rising." from "Growth and unemployment" by Paul Krugman

Bad recipe. Clearly, we can't cut our way out of this deficit. We have no choice but to find a way to grow. If we had high GDP growth (like 7%), we could to cut meaningful amounts (like maybe 10%, assuming 7% GDP growth), and still have rising employment, reducing unemployment. Rising employment would also mean more payroll tax revenues, thus lowering the deficit directly. Growth such as this is the only way to spiral upwards. During slow growth, cuts force a downward spiral.

We can't afford cuts. We have to find a way to grow.